2024 Benefits

Medical Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the 1st day of the month following date of hire.

Summary of Benefits and Coverages

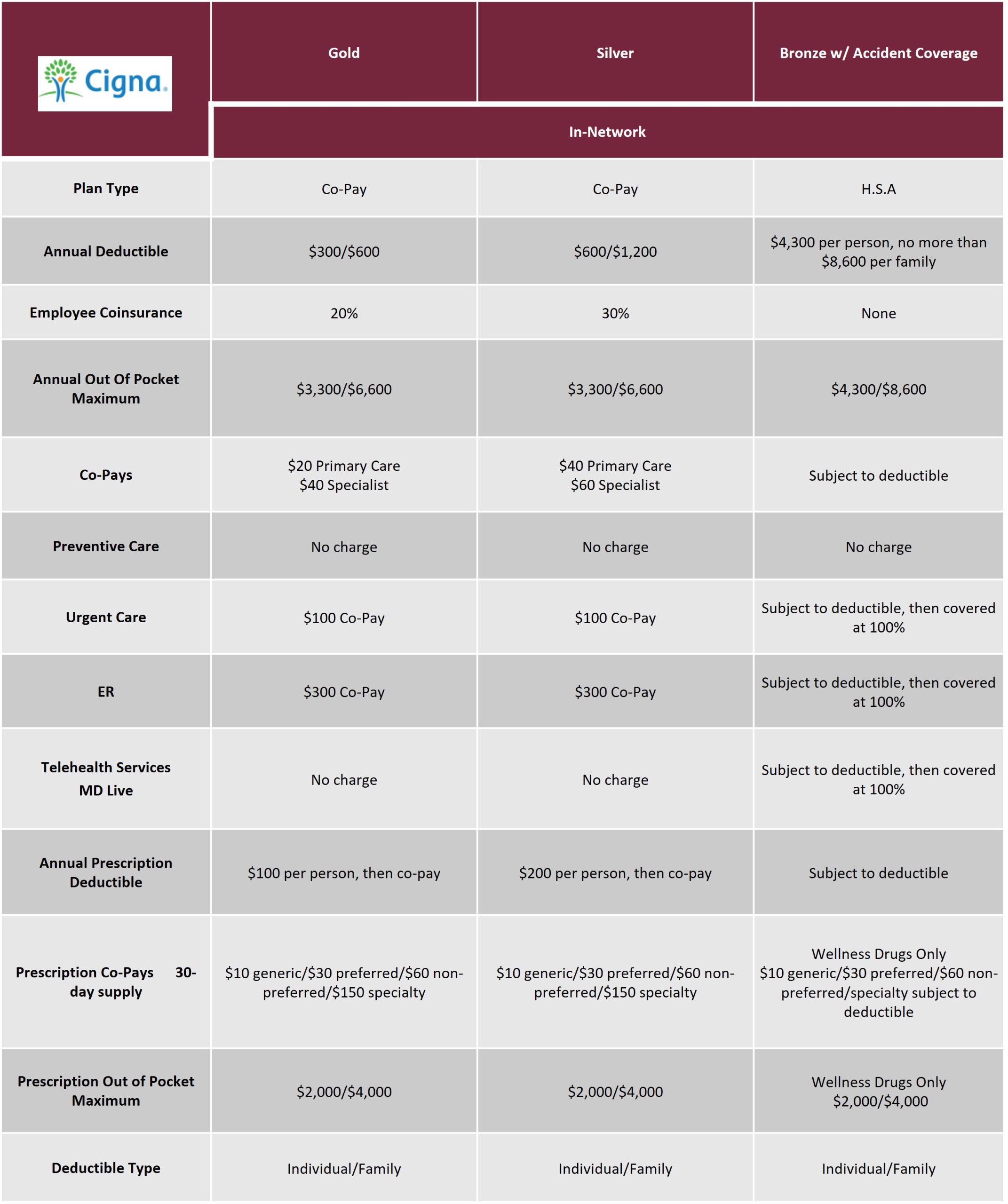

The purpose of the Norwich University Cafeteria Plan is to address each employee’s unique benefit needs by offering plan choice. Norwich University offers three medical plans for employees to choose from – Gold, Silver or Bronze – with varying deductibles, copays, and coinsurance.

The chart below provides a high level overview of the medical plan design and features.

Employees who elect to enroll in the Bronze Plan will also be enrolled in the Group Accident Plan offered by Unum at no additional cost.

All three medical plans offer certain services to covered individuals at little to no cost. These include Telehealth and Preventive Care Services. For more details about these services through Cigna Healthcare, please review the brochures on the Medical – Cigna Value Added Programs page.

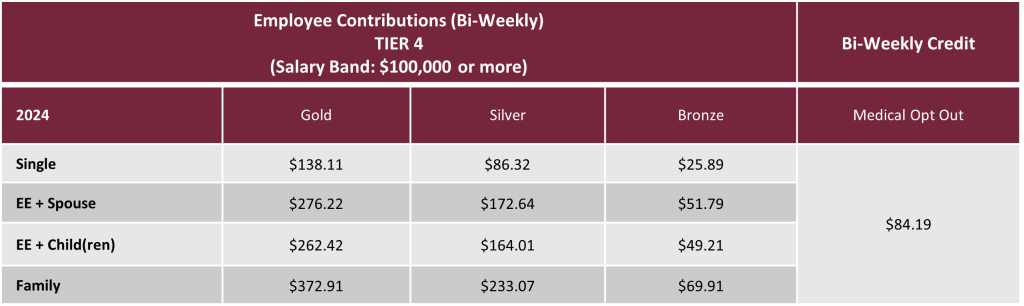

Contributions & Rates

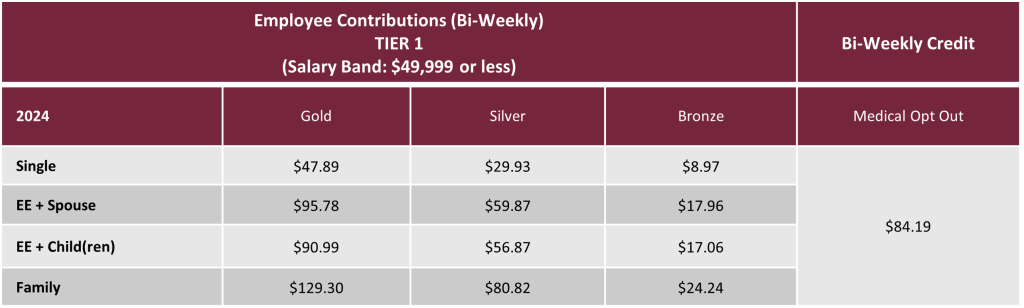

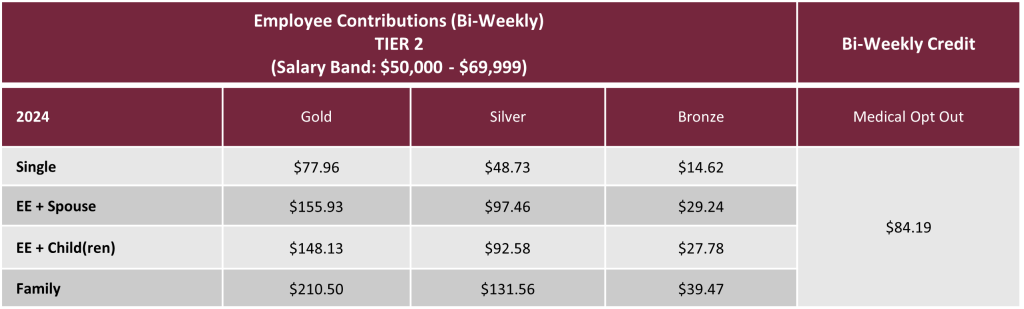

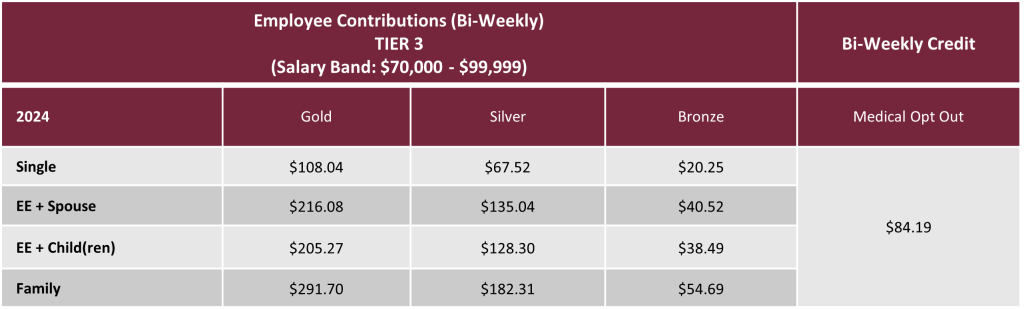

Medical plan rates will be determined by the employee’s base salary at the time of initial enrollment and/or annually during open enrollment.

Important/Please Note: Employees’ spouses who have access to healthcare coverage through another employer are not eligible for enrollment in Norwich University’s Health Plans. This policy allows the University to maintain affordable coverage for its employees, spouses (who have no other healthcare options) and their dependent children.

Pharmacy Information & Resources

The following brochures provide details about prescription drug coverage for all three medical plans.

Carrier Contact Information

Cigna Healthcare: Medical Insurance

Customer Service: 800-244-6224

Website: http://www.mycigna.com

COVID-19 Resource Center: https://www.cigna.com/coronavirus/

Please click here for the Cigna Provider Directory

Forms

Summaries of Benefits & Coverage

Benefit Summaries

Summary Plan Descriptions

Riders

Additional Information

What is considered “Qualified Health Coverage”?

Qualified coverage is any health insurance that meets the Affordable Care Act requirement for coverage, also called “minimum essential coverage” or “MEC”.

Qualifying health coverage usually includes:

- Job-based plans

- Health Insurance Marketplace® plans

- Most individual plans bought outside the Marketplace

- Medicare

- Medicaid

- The Children’s Health Insurance Program (CHIP)

- TRICARE

- COBRA

- Plans sold through the Small Business Health Insurance Program (SHOP) Marketplace

Coverage that usually does not count as qualified coverage:

- Coverage only for vision care or dental care

- Workers’ compensation

- Coverage only for a specific disease or condition

- Plans that offer only discounts on medical services

Qualified coverage must:

- Include 10 Essential Benefits:

- Hospitalization

- Ambulatory Services (office visits and outpatient services)

- Emergency services

- Maternity and newborn care

- Mental health and substance abuse

- Prescription drugs

- Lab tests

- Preventive services

- Pediatric care

- Rehabilitative services

- Has established cost share limits

- Not have any annual or lifetime dollar limits on care.

Additional Links & Resources

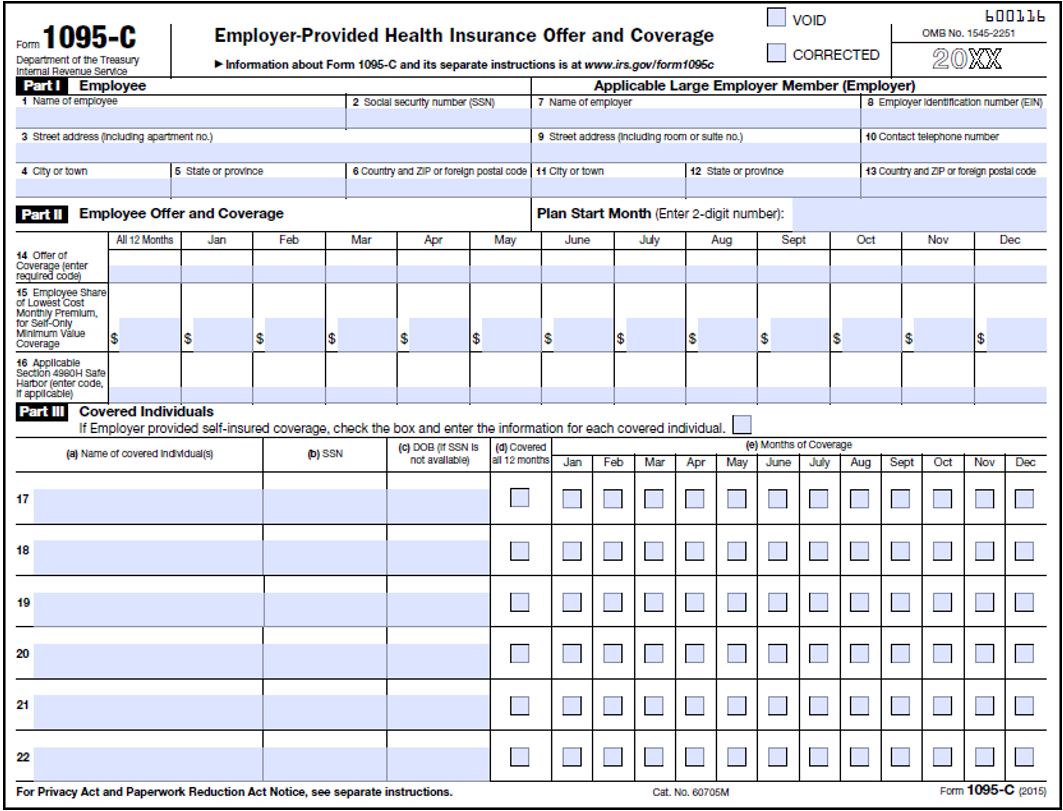

The 1095

Locating this form in your tax documents may help you determine if you were offered a Qualified Health Plan.

Employers with 50 or more full-time equivalent employees are required to send Form 1095 to all full-time employees (those who work an average of 30 or more hours per week) as well as any employee who was enrolled in their health insurance plan. If you were a full-time employee and/or were enrolled in health insurance through your employer at any time during the year, you should receive a Form 1095. It looks like this:

FYI: A 1095 B is sent by fully insured employers while the 1095 C is sent by self-funded groups.

The code the employer uses on Line 14 indicates that an offer of Qualified coverage was made.

Additional Links & Resources

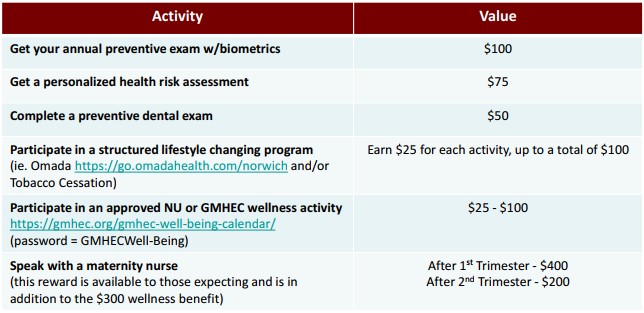

Wellness Incentives & Rewards

Wellness Program Overview

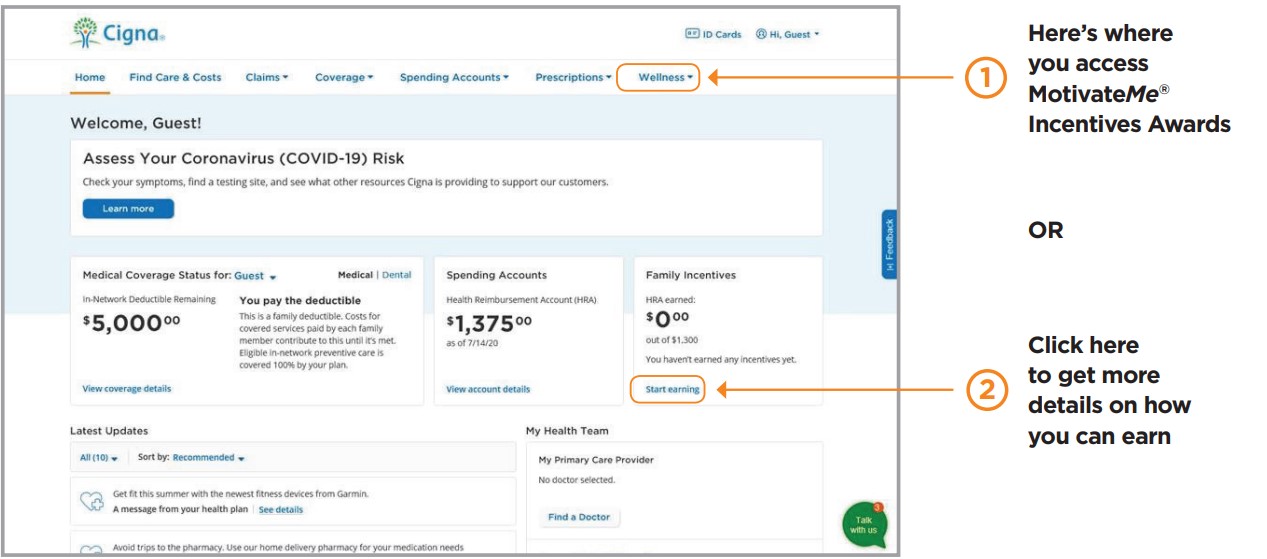

Norwich University uses the Cigna MotivateMe platform to encourage and reward healthy behaviors. All benefit-eligible staff have the opportunity to participate and earn up to $300 in gift cards annually.

Employees can select and participate in any of the activities below to earn rewards.

To get started:

- Visit mycigna.com, login and select Incentive Awards Program

- Or download the myCigna Mobile App

There you’ll find:

- A list of available healthy actions and goals

- Details on how to get started

- Instructions on how to earn and redeem your rewards

Important Contact Information

Cigna Motivate Me Program

Customer Service: 800-244-6224

Website: www.mycigna.com

Omada – Diabetes Prevention Program

Website: https://go.omadahealth.com/norwich

GMHEC

Website: https://gmhec.org/gmhec-well-being-calendar/

VT Quit Network

Customer Service: 1-800-QUITNOW (1-800-784-8669)

Website: www.802quits.org

Additional Information

Medical Plan – Cigna Value Added Programs

Cigna Value Added Programs Overview

In addition to the medical plans offered through Cigna to Norwich University’s employees, there are additional value added programs and services offered to covered individuals at little to no additional cost. These include telehealth and preventive care services.

Please click the box below to watch a short video on the cost comparison tools Cigna offers.

Cigna Telehealth

Employees can access Telehealth services to treat minor medical conditions like colds, flus, sore throats, allergies, and more. Telehealth allows employees to connect with a board-certified doctor via video or phone.

The cost of the Telehealth visit is $0 for the Gold and Silver plans and significantly less on the Bronze plan. Appointments can typically be scheduled within one hour or less. It is recommended that employees complete the registration process before Telehealth services are needed to make scheduling an appointment quicker in the future.

To register, please go to: www.mdliveforcigna.com or call 888-726-3171

Online Health Assessment

Employees can complete a confidential online health assessment to gain a better understanding of your health. After completing the health assessment, a personal health report will be created to provide employees with information about potential health risks, suggestions on what you can do to get healthier, and where to find resources and support.

This health assessment is optional and is provided as a service to support Norwich employees and their health.

To access the health assessment:

- Login to health at www.mycigna.com

- Go to My Health Tab

- Click on the Health Assessment Title

- Click on Get Started

Cigna Healthy Pregnancies, Healthy Babies

Learn how to stay in the best possible health during pregnancy. You can find a wealth of information on mycigna.com from trusted sources like WebMD and Healthwise. You’ll learn how to:

- Make a plan for a healthy pregnancy

- Monitor your pregnancy week by week

- Prepare for labor and delivery

- Care for your baby

To get started, please login to mycigna.com, click on the My Health tab, and then click on My Health Programs & Resources.

Happify

Happify (offered through Cigna) is a free app with science-based games & activities that are designed to help support you and your emotional health.

These activities can help you:

- Gain confidence

- Reduce stress and anxiety

- Increase mindfulness and emotional well-being

- Boost health and performance

After answering a few simple questions, you can participate in the games and activities and earn points to win valuable prizes.

To get started or find out more information, download the free app at: happify.com/Cigna

Talkspace

Cigna has partnered with Talkspace to offer you telebehavioral healthcare from anywhere. Talkspace is an online therapy platform that makes it easy and convenient for you to hold sessions with a licensed behavioral therapist from anywhere, at anytime.

Visit www.talkspace.com/cigna to get started:

- You must be a Cigna medical plan subscriber.

- Report your needs and preferences for therapy.

- An algorithm will suggest 3 potential therapists based on your preferences.

- Select your ideal match and begin therapy that day.

- Payment terms that apply to an in-person visit will also apply to a Talkspace session.

Lifestyle Management Programs

Whether your goal is to lose weight, quit tobacco or lower your stress levels – Cigna Lifestyle Management Programs can help. This program is at no additional cost to employees. Each program is easy to use and available when needed. Employees can use each program online or over the phone -or both.

These programs include:

- Weight Management

- Tobacco Cessation

- Stress Management

To get started or find out more information, please visit www.mycigna.com or call (800) 244-6224

Pharmacy Benefit Education Tools

Cigna Healthcare offers tools to help employees understand the best ways to get the most out of their pharmacy benefit plan. Use mycigna.com to:

- See your pharmacy claim history

- See Rx prices based on your plan

- Ask a pharmacist a question

- Manage home delivery

- Use the drug cost tool

- Get help understanding and managing conditions and the use of specialty medications.

Visit www.mycigna.com or call Cigna Member Services at (800) 244-6224

Omada

Cigna Diabetes Prevention Program in collaboration with Omada is a program to help you avoid the onset of diabetes, as well as health risks that might lead to heart disease or a stroke. The program is covered by your health plan at the preventive level, just like for your wellness visit. Program participants have access to a professional virtual health coach, an online support group, interactive lessons, and a smart-technology scale. The program will help you make small changes in your eating, activity, sleep, and stress to achieve healthy weight loss through a series of 16 weekly lessons and tools to help you maintain weight loss over time. You may also be offered the opportunity to join a gym for a low monthly fee and no enrollment fee.

There is no cost to the members who participate in this program and is highly recommended to members at risk for type 2 diabetes.

To see if you are eligible, take Omada’s 1-minute health screener by visiting: omadahealth.com/norwich

The OMADA Program has open slots!

For more information or to enroll today click the button below:

iPrevail

iPrevail is a digital therapeutics platform designed to help you take control of the stresses of everyday life by:

- Decreasing stress from relationships, work, school and daily life

- Building resilience and positivity

- Overcoming feelings of anxiety

How does it work?

- Sign up for iPrevail on mycigna.com

- Take an assessment

- View interactive video lessons, engage in support communities and online wellness activities

- Earn rewards for getting healthy

To get started or find out more information, visit www.mycigna.com, go to the Stress & Emotional Wellness Page, and click on the iPrevail link.

IdentityForce offered through Cigna

IdentityForce is included in your Cigna medical coverage at no additional cost to you and any child(ren) living in your household up to age 18.

Plan features include:

- Password Manager

- Bank and Credit Card Activity Alerts

- Credit Report Assistance

- Identity Threat Alerts

- And much more!

For more information, visit www.mycigna.com or check out the flyer below.

Flexible Spending Accounts & Dependent Care Accounts

Flexible Spending Accounts

Norwich University offers both health (FSA) and dependent care (DCA) flexible spending accounts. Employees may contribute pre-tax dollars into these accounts to help offset eligible medical expenses or dependent care expenses. These plans are administered by Cigna.

Claims for reimbursement FSA and DCA expenses must be received by Cigna by the following March 31st.

Flexible Spending Medical Account (FSA)

Funds from a health care FSA can be used for qualified expenses including medical, dental, vision, deductibles, co-payments and co-insurance. For a full list of qualified allowed expenses by the IRS, see publication 502 (www.irs.gov/publications/p502). With an FSA, the entire elected amount is available on the first day of the health plan year.

Employees may contribute up to a maximum of $3,200 to the health FSA. The health care FSA includes a rollover provision that allows employees to rollover up to $640 of unused funds into the next plan year.

Employees who elect the Bronze Plan with a Health Savings Account may only contribute to a limited purpose FSA which can only be used for dental and/or vision expenses.

Dependent Care Account (DCA)

A dependent care FSA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care. To qualify for a dependent care FSA, the IRS requires that the dependent care is necessary for you or your spouse to work, look for work or attend school full-time.

The maximum you may contribute to the dependent care FSA is $5,000 (if single or married & filing jointly) or $2,500 (if married and filing separately).

Please note that the DCA is 100% employee funded and is only available to use if monetary contributions have been made.

Carrier Contact Information

Contributions

Made By Employees

Forms and Plan Documents

Health Savings Account

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account owned by an individual that can be used to pay for qualified medical expenses for the owner and their dependents. An HSA, which must be paired with an HSA-qualified health plan (the Bronze plan), allows employees and employers to make pre-tax contributions to a federally-insured account. HSA balances earn tax-free interest, roll over from year to year and can be invested to accelerate growth. at age 65, HSA funds can be withdrawn for any reason and are taxed as income (just like an IRA or 401(k)). Tax-free distributions would continue to be available for qualified medical expenses.

All of the money in an HSA (including any contributions made by an employer) is owned by the employee even if thy leave their job, lose their qualifying coverage or retire. The money in an HSA never expires. All remaining HSA funds roll over each year.

HSA Eligibility

To be eligible for an HSA, an employee must:

- Be enrolled in a qualified High Deductible Health Plan (HDHP) (ie: Bronze Plan).

- Not be claimed as a dependent on another’s tax return.

- Not be enrolled in Medicare.

- Not be insured under any other medical plan that is not a HDHP.

- Have not received VA benefits (Medical or Rx) during the past 3 months.

How to Open a HSA

If an employee wishes to contribute to an HSA, they are responsible for opening an account at a bank of their choice or with an established HSA administrator such as HSA Bank, Health Equity, or many others.

2024 Employer Contributions

Norwich University will match employee’s contributions to an HSA up to a maximum of $20 per pay period (or $520 annually). Employees can indicate how much they want to contribute to an HSA during the bswift online enrollment process and must also provide HSA account information to Human Resources. Norwich University will deposit the employee contributions into the employee’s HSA through bi-weekly payroll deductions.

Please note that you are responsible for providing HSA account information to Human Resources.

2024 HSA Contribution Limits

- Employee Contribution Limit: $4,150 Single; $8,300 Family

- Catch Up Provision: $1,000 additional for employees aged 55 or older

- Employer Contribution Limit: Will match employee contribution amount to a maximum of $20 per pay period (or $520 annually)

FSA/HSA Store

Norwich University has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Dental Benefits

Eligiblity

All employees who work a minimum of 30 hours per week are eligible for coverage on the 1st day of the month following date of hire.

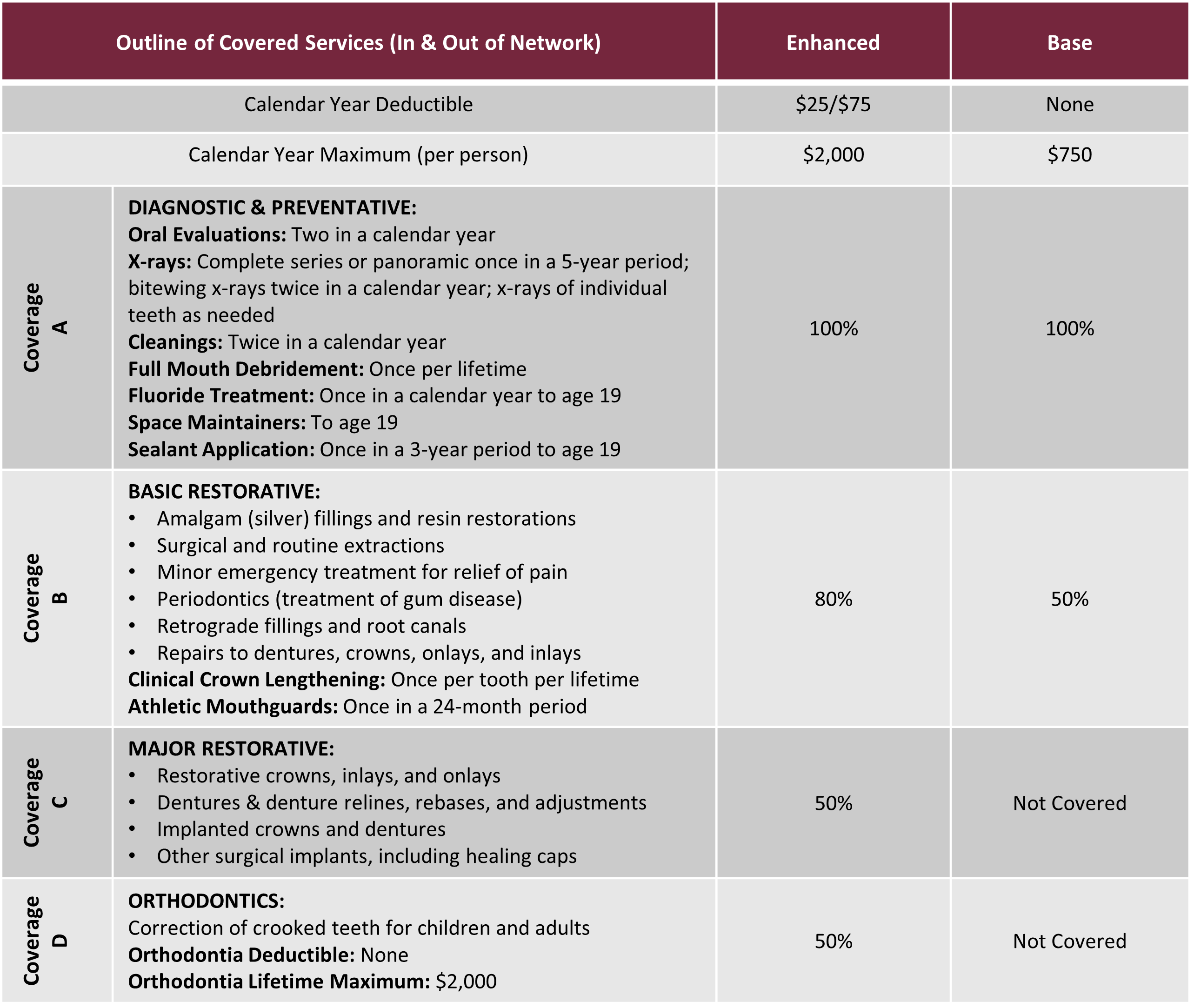

Summary of Benefits and Coverages

Norwich University offers benefit eligible employees the choice between two dental plans which have varying coverage levels.

The chart below provides a high level overview of the dental plan design and features.

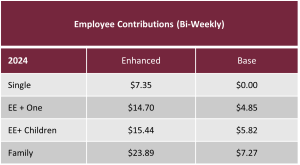

Contributions & Rates

Carrier Contact Information

Northeast Delta Dental

Customer Service: 800-832-5700

Website: www.nedelta.com

Please click here for the Delta Dental Provider Directory

Forms and Plan Documents

Additional Information

Vision Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following date of hire.

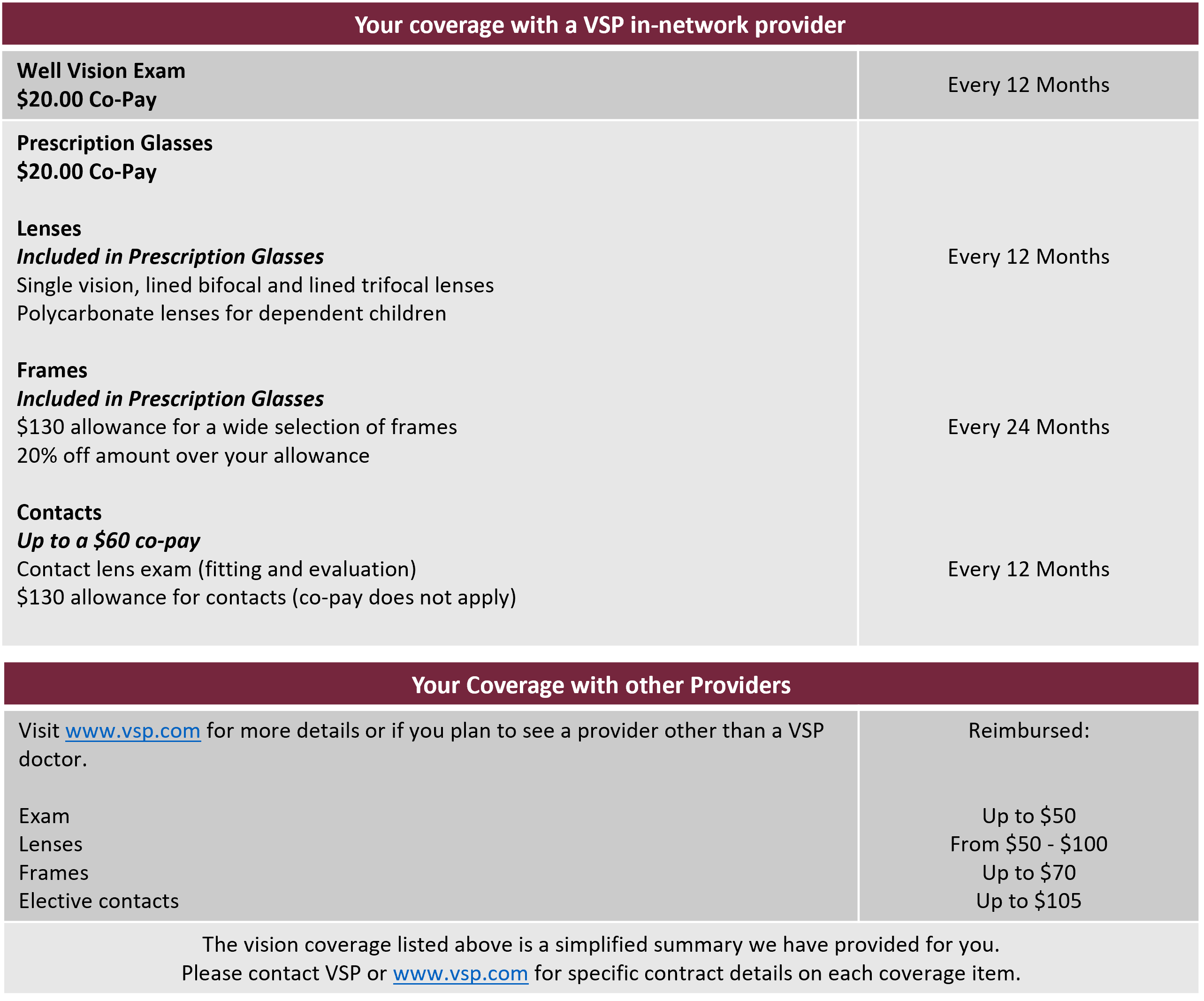

Summary of Benefits and Coverages

Norwich University offers voluntary 100% employee paid vision coverage through VSP.

The chart below provides a high level overview of the vision plan design and features.

Please be sure to check whether or not your provider is a member of the VSP network.

Eyeconic – Online Eyeglass Store

VSP has partnered with Eyeconic to offer more savings to you and your family on the purchase of lenses, frames, contacts and sunglasses with the Eyeconic online eyeglass store. Please click on the link button below for more information.

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Click here for the VSP Provider Directory

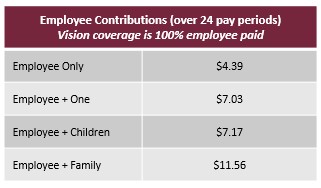

Contributions & Rates

Forms and Plan Documents

Additional Information

Group & Voluntary Life Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following date of hire.

Summary of Benefits and Coverages

Norwich University provides benefit-eligible employees with the core benefits of life insurance and accidental death & dismemberment insurance. In addition to these core benefits, employees can supplement their plans by purchasing voluntary life insurance to cover themselves and their families.

Below is an outline of the coverages available under each plan.

Basic Term Life & AD&D Insurance:

- 100% funded by Norwich University

- 1x salary to maximum of $370,000

- Minimum coverage amount of $15,000

- Coverage amounts will reduce by 35% at age 70 and by 50% at age 75

- Basic AD&D coverage amount is equal to the Basic Life coverage amount

Voluntary Employee Term Life & AD&D Insurance:

- 100% employee funded

- Employees may elect coverage in increments of $10,000 to a maximum of 5x salary or $500,000 (whichever is less) to cover themselves

- Non-medical maximum is $200,000*

- Coverage amounts will reduce by 35% at age 70 and by 50% at age 75

Voluntary Spouse Term Life & AD&D Insurance:

- 100% employee funded

- Coverage is available in units of $5,000 (not to exceed 100% of the employee’s optional life insurance) to cover the employee’s spouse

- Non-medical maximum is $25,000*

Voluntary Child Term Life & AD&D Insurance:

- 100% employee funded

- Coverage is available in units of $2,000 to a maximum of $10,000 (not to exceed 100% of your optional life insurance coverage)

*Employees may elect up to $200,000 in optional life coverage for themselves (or $25,000 for their dependent spouse) within the first 31 days of employment without having to complete a medical history statement (evidence of insurability form). If applying outside the first 31 days of employment, or for coverage in excess of $200,000, a medical history statement is required and approval is subject to medical underwriting.

Carrier Contact Information

Unum: Life, Optional Life & Disability Insurance

Customer Service: 800-421-0344 (Life, Optional Life, LTD & STD)

Website: www.unum.com/register

Contributions

Group Life is 100% paid for by Norwich University.

Voluntary Life is 100% paid for by the employee. Premium costs are based on the amount of coverage approved and the age of the participant.

Forms and Plan Documents

Long-Term Disability

Eligibility

Long-Term Disability: All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following date of hire.

Summary of Benefits and Coverages

Long Term Disability insurance provides partial income when you are unable to work due to sickness or injury.

Class 1 LTD – Staff:

- 100% funded by Norwich University

- Benefits begin after 90 days of any one period of total disability

- Benefit is 66.67% of monthly earnings to a maximum benefit of $7,500 per month

- Benefit duration is to age 65 if disabled prior to age 62. If older, schedule of benefit duration is based on age

Class 2 LTD – Faculty:

- 100% funded by Norwich University

- Benefits begin after 180 days of any one period of total disability

- Benefit is 66.67% of monthly earnings to a maximum benefit of $7,500 per month

- Benefit duration is to age 65 if disabled prior to age 62. If older, schedule of benefit duration is based on age

LTD is administered by Unum and the employee has the option of taking the premium cost as additional salary and paying the premium with after-tax dollars to achieve a tax-free benefit. Please contact Human Resources for details.

Contributions

LTD Insurance is 100% funded by Norwich University.

Carrier Contact Information

Unum: Long-Term Disability Insurance

Customer Service: 800-421-0344

Website: www.unum.com

Forms and Plan Documents

Accident & Critical Illness Insurance

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage only during the annual open enrollment period.

Summary of Benefits and Coverages

Accident Insurance:

Employees and dependents who enroll in the Bronze High Deductible Health Plan (HDHP) will automatically be enrolled in Accident Insurance through Unum. This benefit plan is intended to supplement the Bronze HDHP by providing additional coverage for accidental injuries. Coverage in Accident Insurance for Bronze Plan members will be 100% employer funded.

Employees who enroll in the Gold, Silver or Medical Opt Out Plan have the option of choosing to cover themselves and their dependents. This coverage is 100% voluntary and is 100% employee paid.

Group Accident Insurance is designed to help employees meet the out-of-pocket expenses and extra bills that can follow an accidental injury, whether minor or catastrophic. Lump sum benefits are paid directly to the covered employee if they sustain a covered injury.

Examples of covered injuries include:

- Broken bones

- Burns

- Coma

- Cuts repaired by stitches

- Eye injuries

- Torn ligaments

Critical Illness Insurance:

Group Critical Illness Insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness.

Coverage is available for employees, spouses, and children. Coverage levels can be elected from $10,000 – $30,000 in increments of $10,000 for employees. Spouse coverage is 50% of the employee election amount. Coverage for children is automatically included with employee coverage with a maximum of 25% of the employee coverage amount.

Elections that exceed the guarantee issue amounts for employees ($10,000) and for spouses ($5,000) will require completion of a medical history statement (EOI).

Examples of covered illnesses include:

- Blindness

- Cancer

- End Stage Renal (Kidney) Failure

- Heart Attack

- Major Organ Failure

- Stroke

Enrollments for both Accident and Critical Illness Insurance can be made in the Bswift benefit enrollment system. Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis. Premiums are deducted over 24 pay periods per year.

Be Well Incentive Program

Employees who enroll in Critical Illness through Unum are eligible to receive a $50 incentive for important tests and screenings. For example, an employee who receives an annual exam by a physician can receive $50 by filing a claim with Unum. For more information please contact your HR representative.

Carrier Contact Information

Unum: Accident & Critical Illness Insurance

Customer Service: 800-421-0344

Website: www.unum.com

Contributions

Accident and Critical Illness Insurance are voluntary and 100% Employee Funded.

Employees who elect to enroll in the Bronze Medical Plan will automatically be enrolled in Accident Insurance which will be funded by Norwich University.

Accident and Critical Illness rates can be viewed by clicking on the summary documents below or during the bswift online enrollment.

Forms and Plan Documents

Group Legal Insurance

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following date of hire.

Summary of Benefits and Coverages

Group Legal Insurance is voluntary and 100% Employee Funded.

Benefit eligible employees have the option of enrolling in Group Legal Insurance through Legal Shield. Legal Shield offers legal assistance in many areas of law including:

- Home Purchases

- Will Preparation

- Child Support

- Insurance Claims

- Bankruptcy

- IRS Audits

- Divorce

- Identity Theft

Employees who wish to enroll can access the Legal Shield enrollment website link in Bswift. Premiums can be paid through payroll deductions (24 pay periods per year). For more information, please contact Legal Shield.

Forms and Plan Documents

Carrier Contact Information

Legal Shield: Group Legal Insurance

Customer Service: 800-654-7757

Website: www.legalshield.com/info/norwich

Contributions

Group Legal Insurance is a voluntary benefit that is 100% Employee Funded.

Premiums can be paid through payroll deductions (24 pay periods per year).

Workshops

One of the many FREE legal services available to those enrolled in the LegalShield employee benefit is the creation of a Last Will and Testament. This personalized and comprehensive Will is, by itself, a $750 – $1,000 value.

We’re excited to announce that LegalShield has created a “Will Workshop” video that is now available to ALL EMPLOYEES on a 24/7 basis, simply by clicking on the following link: https://attendee.gotowebinar.com/recording/5779521710280211971

Pet Insurance

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following date of hire.

Summary of Benefits and Coverages

Pet Insurance is voluntary and 100% Employee Funded.

Benefit eligible employees have the option of enrolling in Pet Insurance through Nationwide Pet. Employees may purchase coverage on dogs, cats and birds. All policies are individually underwritten and monthly rates are determined by breed, age, species, type of plan selected and state of residence. Employees who wish to enroll can access the Nationwide Pet enrollment website link during the Bswift online enrollment process. Premiums can be paid through payroll deductions (24 pay periods per year).

For more information, please contact Nationwide Pet.

Forms and Plan Documents

Carrier Contact Information

Nationwide Pet: Pet Insurance

Customer Service: 877-738-7874

Website: http://www.petinsurance.com/norwich

Contributions

Pet Insurance is a voluntary benefit that is 100% Employee Funded.

Premiums can be paid through payroll deductions (24 pay periods per year).

Additional Information

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by Norwich University

Program Details

The EAP is a confidential assistance program offered by Norwich University at no cost. This program offers support, guidance and resources to help you and your family find the right balance between your work life and your home life.

EAP services are available to all employees, their dependents, including children up to age 26, and all household members. Some of the services available are child care and elder care referrals, life improvement, stress & anxiety at work, goal-setting, financial & legal concerns, and online will preparation.

EAP Contact Information

Unum: Employee Assistance Program

Tl#: 800-854-1446

Website: www.unum.com/lifebalance

Additional Information

Employee Advocate

Program Details

The Richards Group can assist employees who are having trouble resolving unpaid/denied medical or prescription claims.

Please contact Cigna at least once to attempt to resolve the claims issue/dispute.

If assistance is still needed, contact Norwich University’s Employee Advocate, whose services are provided to you at no cost.

You can email the Employee Advocate at employeeadvocate@therichardsgrp.com

Contact Information

The Richards Group: Employee Advocate

Email: employeeadvocate@therichardsgrp.com

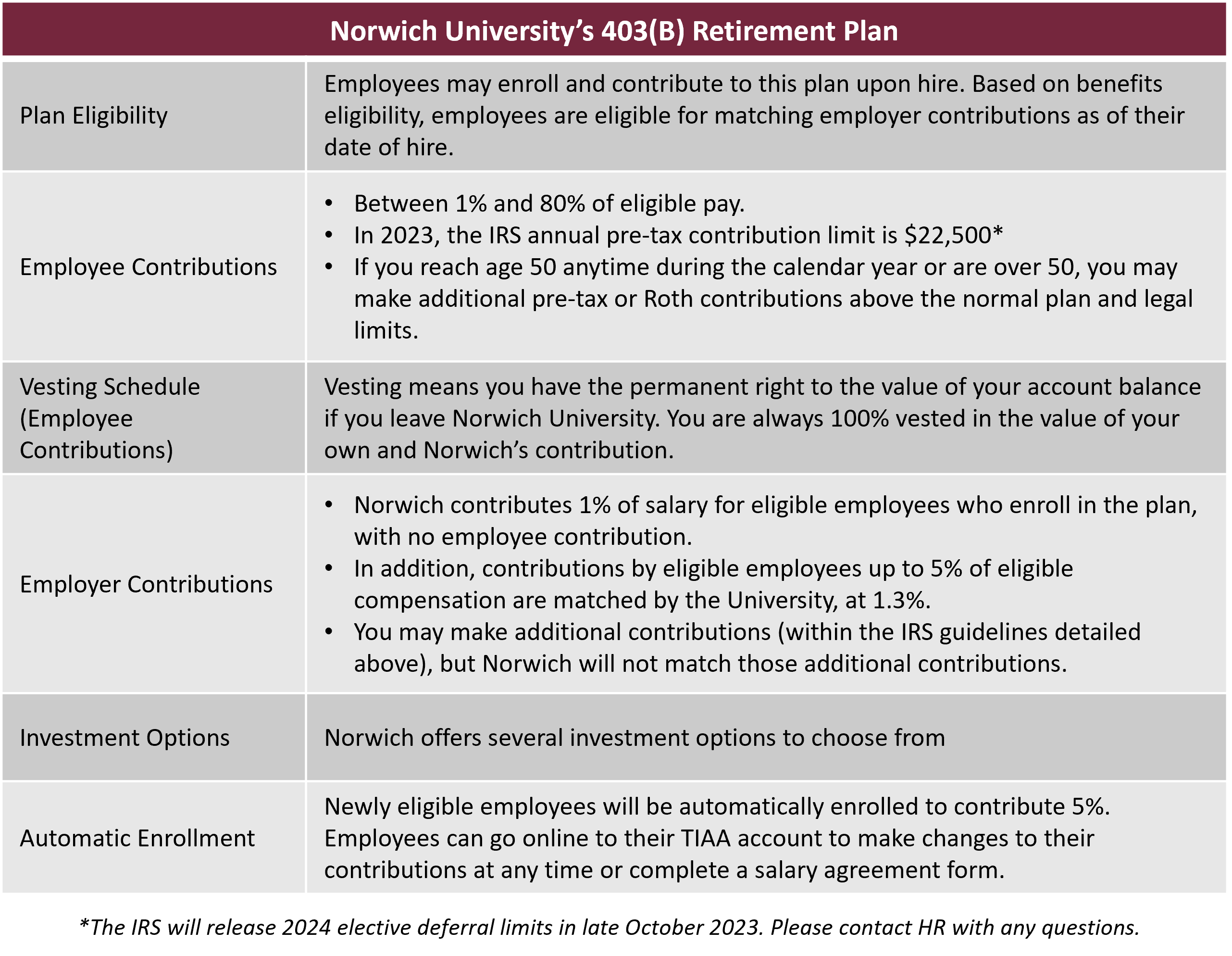

403 (b) Retirement Plan

Eligibility

Employees may enroll in and begin to make contributions to this plan upon hire. Employees are eligible for matching employer contributions as of their date of hire following an admin period.

Plan Details

Managing your TIAA Retirement Account Online

To Enroll:

- Go to TIAA.org/Norwich

- Click Ready to Enroll or Update, chose your plan(s), and if you haven’t already, complete a salary reduction agreement

- If you are a first time user, click Register with TIAA to create a user ID & password

- If you are a returning user, enter your TIAA user ID and click Login

- Follow the prompts and print out the confirmation page

- You are now enrolled

To Change Contributions:

- Go to TIAA.org/Norwich

- Click Login in the top right-hand corner

- Enter you TIAA user ID & password

- In the My Account drop-down menu, select Change my Contribution

- Update the percentage for your contributions and the date to make the change effective

ELECTIVE DEFERRALS

- In addition to the contributions eligible for matching employer contributions (described above), employees may make additional retirement contributions; however, these contributions are not matched.

- The plan includes a provision for loans on supplemental contributions.

- To make changes to your retirement elections, go online to your TIAA account.

- Changes must be made six business days prior to the pay date in order to process for the next pay date.

- Newly eligible employees will be automatically enrolled to contribute 5%. Employees can go online to their TIAA account to make changes to their contributions.

AFTER-TAX ROTH OPTIONS

- Employees may make after-tax contributions to both the Match Contributions and/or the elective deferrals with the Roth Option.

- Contributions made with after-tax dollars will be tax-free at withdrawal when you reach age 59 ½

NU @ Work – TIAA Webinars

You can view the full webinar details and register in the flyers on the right. If you are unable to attend the scheduled sessions, please register and you will have the ability to go back and listen to it for 90 days after the webinar has occurred.

These webinars are now open to all and are available now in the Live Webinar Lounge by going to: www.tiaa.org/webinars

Carrier Contact Information

TIAA: 403(b) Retirement Plan

Customer Service: 800-842-2776

Fax: 800-914-8922

Website: www.tiaa.org/public/tcm/norwich

Additional Information

Monthly TIAA Webinars

Medicare Information

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Agents will provide an unfiltered view of the entire range of options and prices available.

SmartConnect: Upcoming Webinars

When considering the transition to Medicare, the terminology and number of choices can feel overwhelming. SmartConnect is here to provide clarity and simplify the process so that you can find the coverage that best fits your needs and budget.

SmartConnect’s virtual Medicare Webinars provide the education you need to make a confident decision about your health care coverage.

Medicare: Central VT Council on Aging -Medicare Counseling (“SHIP”)

Customer Service: 802-479-0531

Email: info@cvcoa.org

Central Vermont Council on Aging provides information, counseling, and assistance to all Medicare eligible persons under the auspices of the State Health Insurance & Assistance Program or “SHIP.”

Their staff counsels individuals and provides workshops to the public on Medicare. They can answer questions about Medicare, private insurance plans, supplemental insurance plans, and Vermont State insurance programs. They also offer regularly scheduled “Medicare & You” workshops in locations convenient to you.

Additional Resources & Information

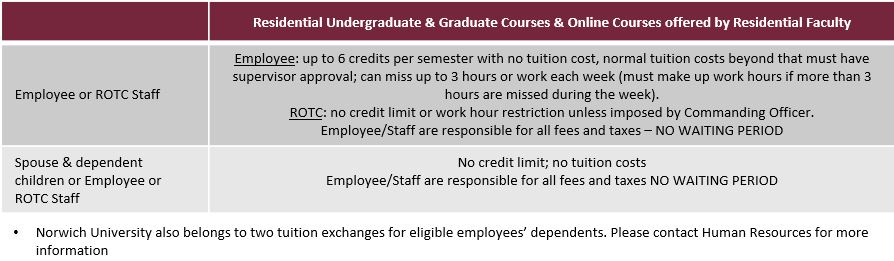

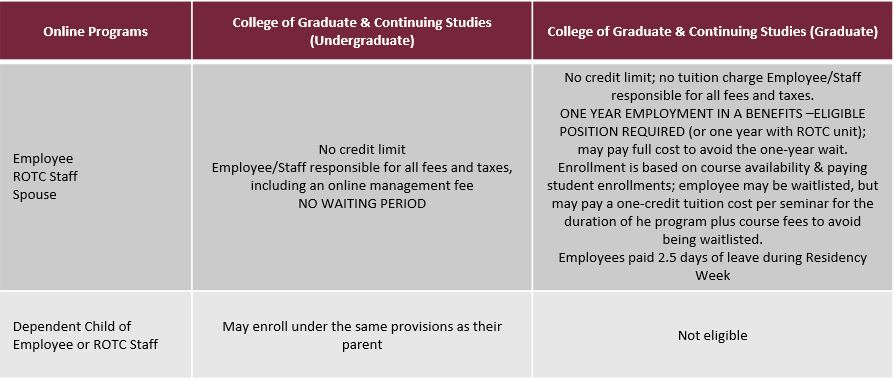

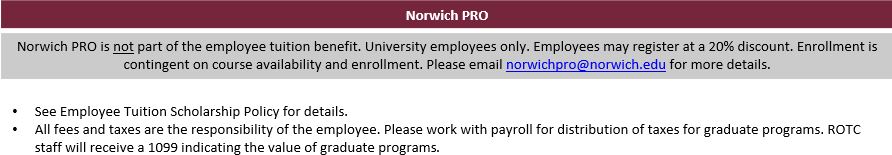

Tuition Benefit & Additional Benefits

Tuition Benefit

Eligibility

Norwich University provides various tuition benefits to regular employees who are scheduled to work 30 or more hours per week, to ROTC staff (active duty and full-time civilians), to their spouses, and to their eligible dependent children, according to the below table. Please also reference the Tuition Benefit Policy for further information.

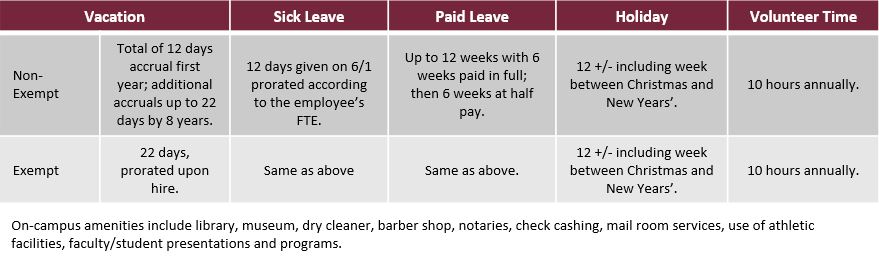

Additional Benefits Provided By Norwich University

Contact Information

Norwich University Human Resources

For further information, please reach out to Norwich University Human Resources:

Phone: 1 (802) 485-2075

Email: nuhr@norwich.edu

Additional Information

Public Service Loan Forgiveness (PSLF)

Norwich University is a PSLF employer. If you have 120 on time payments while working for a qualified employer, you can have your federal student loans forgiven. For more information, visit the Federal Student Aid website or contact Human Resources.